One Little Tweet

Tesla is one of the most divisive stocks since it went public in 2010. Presently, Tesla’s stock is one of the most highly traded stocks with an average volume of 11 million trades every day. It is currently sitting at $190 nearly half of what it was five months ago when Elon Musk famously announced:

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

Three weeks after Elon’s famous tweet Tesla published on their blog that they would be remaining public. Naturally, the stock dropped back down - many investors were quite unhappy.

Is Tesla ready for a rebound? Or has the death knell sounded marking the end of Tesla’s tumultuous journey?

Some doomsayers such as Morgan Stanley predict the stock will be worth $10. Others predict it will be worth $4000 or about $700 million in market value - not too far from Apple and Amazon.

When there’s a lot of controversy it becomes very difficult to sift through all the bullshit. Not one to enjoy reading bullshit, I decided to consolidate my thoughts into this post so that others will not have to do the same.

Through my research, one thing I’m sure of is that Tesla certainly has and is continuing to disrupt the automotive industry. We are living in a special time in history. The last time the automotive industry was disrupted like this was in 1908 when the Model T was released.

What topics will be discussed?

This post will be a holistic overview. This analysis has an outlook of about 10 to 20 years of the EV industry and Tesla. Warning this post is long. Unlike other posts out there, this isn’t about scaring people or clickbait. It’s an attempt at a thoughtful analysis focused on fact – no BuzzFeed listicles here!

So what will be talking about today? First some thoughts on the stock markets and how to think about them. Then we will delve into whether the EV market will supersede the ICE market? Will Tesla’s vehicles be more competitive than competing EV’s? Is Tesla’s balance sheet sufficient to make it to the long term?

Truthfulness & Biases

In this day and age, it’s very easy to lie with graphs and numbers. As someone who simply wants to understand better, I will do my best to honest to you as well as with myself. Humans are prone to many biases especially when trying to prove something.

I also want to acknowledge that I (as is everyone else) is subject to the human condition. I am susceptible to in-group out-group bias, availability bias, and confirmation bias as well as all the pleasantries of the amygdala.

I’ll do my best to compensate for these biases in the analysis.

A Note on Stock Markets

I believe in a weak version of the EMH - that every stock price is a rough approximation of its true value. I know this a bit controversial; however, the way I see it is that I respect the huge agglomeration of minds that together are in a chaotic yet beautiful constant state of valuing companies. I respect that giant mass of distributed brain power (machines too) and believe in many respects that it is much smarter than me (at least most of the time 😉). The stock market is considered a level 2 chaotic system so needless to say it’s difficult for an observer to predict the future value of a stock. Also, humans are emotional (perhaps their algorithmic machines are too). Kahneman in “Thinking Fast and Slow” has some interesting thoughts on this and does give merit to why the markets are NOT very efficient.

Electric Vehicles vs. Internal Combustion Engine Vehicles

It’s important to think about the automotive market as a whole. Will EV’s change the market forever? Or is it just a fad? ICE vehicles have dominated the market ever since horses went out of style. There have been various attempts over the years to move on from ICE using hydrogen fuel cells, hybrids and EV’s. I believe that the market will eventually draw towards the best type. How do to define the best? Cost to build, energy efficiency, maintenance costs. We’ll focus on ICE’s and EV’s in this post.

Energy Efficiency

According to the US Department of Energy’s Office of Energy Efficiency and Renewable Energy, “EVs convert about 59%–62% of the electrical energy from the grid to power at the wheels. Conventional gasoline vehicles only convert about 17%–21% of the energy stored in gasoline to power at the wheels.”

That means that EV’s are roughly 3x times more energy-efficient even if they were to rely on electricity that comes directly from gasoline – power plants can more efficiently convert gasoline to electricity than your ICE vehicle ever could. This helps point to why EV’s have much better MPGe.

Update: as of Aug. 30, 2020, the numbers are even better for EV’s: “EVs convert over 77% of the electrical energy from the grid to power at the wheels. Conventional gasoline vehicles only convert about 12%–30% of the energy stored in gasoline to power at the wheel”.

Maintenance & Insurance Costs

I recommend reading the articles below but the synopsis for EV’s is: - There is more tire replacement due to high vehicle weight from battery - Battery replace will be necessary every 10-15 years - Fewer moving parts to maintain (spark plugs, wires. muffler) - Fewer fluids (no oil or transmission fluid) - Less wear & tear on breaks (through regenerative breaking) - Insurance costs are relatively high for luxury vehicles but could decrease from Tesla Insurance

https://insideevs.com/news/317307/ev-vs-ice-maintenance-the-first-100000-miles https://techcrunch.com/2020/03/06/electric-vehicles-are-changing-the-future-of-auto-maintenance/ https://hbr.org/2019/05/teslas-strong-brand-gives-it-unusual-expansion-potential https://www.energy.gov/eere/electricvehicles/electric-car-safety-maintenance-and-battery-life

Big Opportunities

- The Tesla Semi

- FSD

- Tesla Insurance

- Tesla Solar

Health of Tesla

Cash

Elon Musk semi-regularly sounds out emails to all of his employees. Some of them are quite positive. Many are alarm bells and scary to read - you can read the full one here. I’ll highlight a particularly interesting yet unsettling quote here:

It is important to bear in mind that we lost $700 million in the first quarter this year, which is over $200 million per month. Investors nonetheless were supportive of our efforts and agreed to give us $2.4 billion (our net proceeds) to show that we can be financially sustainable.

That is a lot of money, but actually only gives us approximately ten months at the first-quarter burn rate to achieve breakeven. It’s vital that we respect the faith investors have shown in Tesla, but it will require great effort to do so.

Where is all the money going? Let’s take a look at a breakdown of their spending

If tesla makes it through the short term many it can start reaping the benefits of its R&D in the future

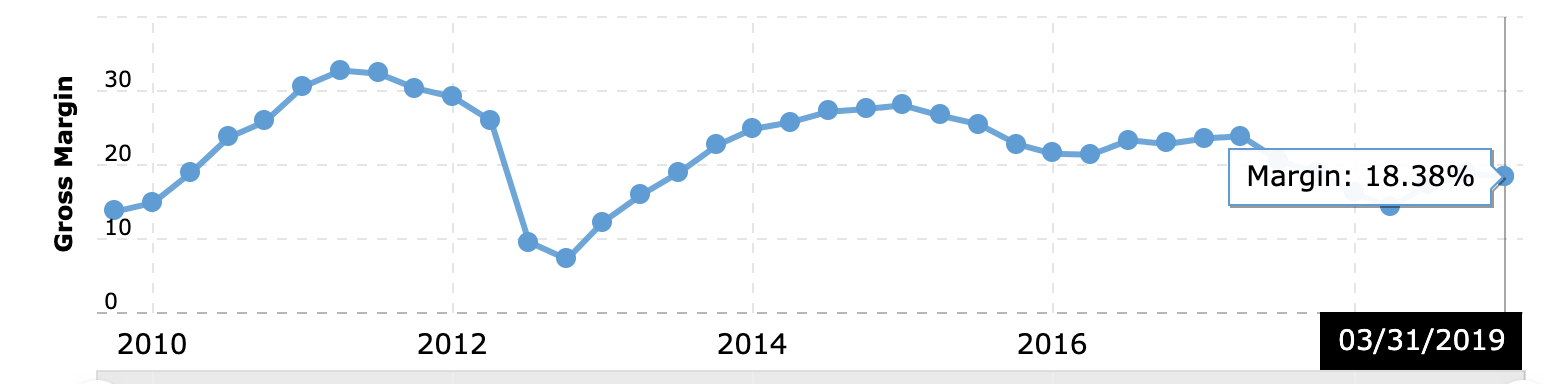

https://www.macrotrends.net/stocks/charts/TSLA/tesla/gross-margin

Tesla Gross Margin Overtime

Burning cash or aggressive growth?

Supply & Demand

Some graphs

Brand Perception

Customer Satisfaction

It may come to no surprise to some that Tesla owners have the highest satisfaction of any brand. They are very happy with their cars even with the horror stories revolving around service centers or price changes soon after purchase. Tesla has a devoted fanbase sometimes it’s equated to a cult-like following. People who post negative content about Tesla are often bombarded with insults and a slew of dislikes.

Treatment of workers

Thoughts on Vertical Integration

No dealerships Cheap batteries - https://www.wsj.com/articles/tesla-ceo-elon-musk-unveils-line-of-home-and-industrial-battery-packs-1430461622?mod=trending_now_2

Motors

Other parts

Full Self Driving

Robotaxis $$$

Automated trucks $$$ \

, safety, laws against human drivers?

Macroeconomic factors

Elon Musk

Vision & Drive

The Compensation Plan

“On January 21, 2018, the board of Tesla, Inc. (Tesla), an electric car and clean energy company, approved an unusual executive compensation plan for CEO Elon Musk. Most compensation packages for U.S. executives included a mix of a base salary and short- and long-term incentives, but Tesla’s plan bucked the norm. Per the plan’s terms, Musk would only be paid if Tesla achieved a series of ambitious market capitalization (cap), revenue, and EBITDA milestones. He would receive 1.69 million Tesla shares—equivalent to about 1% of total outstanding common stock—if the company’s value (at the time, $59 billion) increased to $100 billion and he achieved an operational target (see Exhibit 1 for these targets).3 For each additional $50 billion in value that Tesla realized (plus attainment of operational targets), Musk would receive an additional 1.69 million company shares. If he met all targets, he stood to gain some $55 billion in equity. But if he failed, he would not be compensated at all” - Harvard Business Review

#Some true negative statements about Tesla Yes, it’s valued more than Ford even though Ford’s revenue is nearly 8x more. Yes, they have a debt & cash problem Yes, their CEO is erratic on Twitter Yes, they have product quality issues

Yes, these risk factors identified by Tesla

I recommend reading the Risk Factors filed in Tesla’s 2019 10k A summary of some of the highlights (lowlights?): - safety risks with storing batteries in factories - fires are a hazard - government regulations - a pandemic

Some risks for Tesla

They don’t have enough demand vs delivery - https://www.fool.com/investing/`019/04/28/elon-musk-comment-should-terrify-tesla-investors.aspx Full Self Driving (FSD) isn’t achievable within 10 years They open-sourced all their patents - any competitor can use their technology (there are contingencies however) China could possibly isn’t interested in an American Electric Car. Fleet wide hacks Vehicle recalls (additional risk because of software?)

What makes Tesla have potential

EV vehicles are very likely the future of the automotive world. I believe the vast majority of gas cars (if not all) will be replaced EVs by 2050 in the US. (energy efficiency, Gov’t is incentivized to reduce pollution, reduce dependency on foreign oil, protect its citizens) This a huge Product quality (yes, this was repeated)

Electric Car Energy efficiency Less moving parts. Less maintenance required. Ice Car

what patents does it have?

What companies does it own?

it has 22 billion dollars in assets

cost-cutting, dependency on debt

Model 3 product recall could be devastating

Concluding Thoughts

Whether you hate or love tesla, few could argue that Tesla isn’t accomplishing their mission to accelerate the world’s transition to sustainable energy. I think it has had a very strong net positive on the world. I hope for their continued success and believe they will succeed which is partly why I own Tesla stock myself.

Please share your thoughts!

Sources

https://ir.tesla.com/events-and-presentations

https://www.consumerreports.org/cro/index.htm

Additional Notes

I began writing this post on 2019-04-28.

This post is a “living” document and may be updated over time.

Staging Area

Elon has started many companies. Interestingly, Tesla was not one of them. Tesla (originally called Tesla Motors, Inc.) was founded in 2003 by Martin Eberhard and Marc Tarpenning neither of which are working at the company anymore although they are both shareholders. It’s had a tumultuous history but its still kicking and screaming in 2019.

Let’s take a look at some graphs to get a sense of Tesla' progress since 2010 (when they went public)

All graphs are from https://www.macrotrends.net/ for the timeframe 03/31/2010 to 01/01/2019

https://www.sfgate.com/cars/article/tesla-repair-wait-time-complaints-electric-car-13796037.php